The Credibility of Sovereign Promises is at Stake

By Santhosh D’Souza.

India’s finance minister, Nirmala Sitharaman, emerged from a relatively long period of silence and right away, dropped a bombshell. On 27th August, she chaired a GST Council meet in which the Revenue Secretary laid out options for the states to borrow from banks to make up for the GST revenue shortfall, estimated at Rs. 2.35 lakh crore. What caused raised eyebrows was her curious characterization of the economic crisis as “an Act of God” via the COVID19 pandemic.

To comprehend how disingenuous her statement is, one has to evaluate the state of the economy and in particular the GST outcomes over the last two years. The late Arun Jaitley, then Finance Minister, authored a self-congratulatory note one year after the country implemented the Goods and Services Tax. The justifications he provided for celebrating are worth revisiting.

- “We have had amongst the smoothest switchovers in one of the largest tax reforms in the country.”

- “The GST will strengthen the country’s tax base for the medium term, adding up to an additional 1.5 percentage points of GDP.”

- “I agreed to pay to the states… a 14% increase of revenue for the first five years for any loss of revenue. The states jumped for this proposal and we succeeded in winning trust of the states back for the GST enactment. Our positive commitment to federal principles was unambiguously established.”

The first two statements are easily demolished. The GST regime has been plagued by illogical tax slabs, constant movement of goods and services back and forth among the slabs, exclusion of some goods, mis-alignment with Reserve Bank of India’s inflation-targeting, technical glitches, fraud and evasion, as illustratively chronicled here and here. No sensible economist or financial analyst echoes Jaitley’s claim.

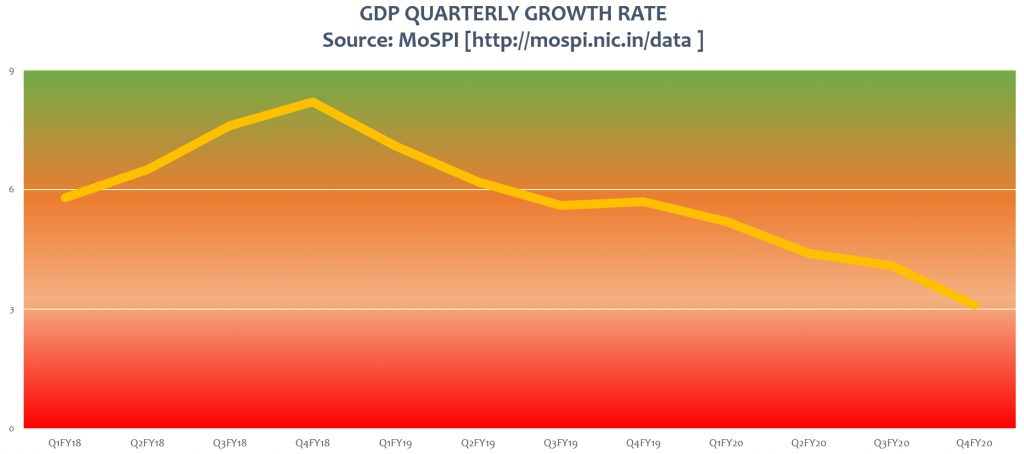

GST adding 1.5 percentage points to GDP in the medium term was fluff. With the “medium term” undefined, the assertion could not be contested. When Jaitley wrote in July 2018, GDP growth had already plummeted one full percentage point, and has declined ever since. If we are in Jaitley’s “medium term” already, his claim if true implies that India’s GDP growth without GST would be sub-3% since July 2019. An abysmal state of affairs for a government that ruled with a majority for 5 full years.

It is the third claim that turns out to be especially egregious. Jaitley hailed the BJP government’s “commitment to federal principles” and says “he agreed” to compensate states. It is worth pointing out that he actually meant the Central Government made a sovereign promise to the states guaranteeing tax revenues until 2022, in exchange for passage of the GST Bill.

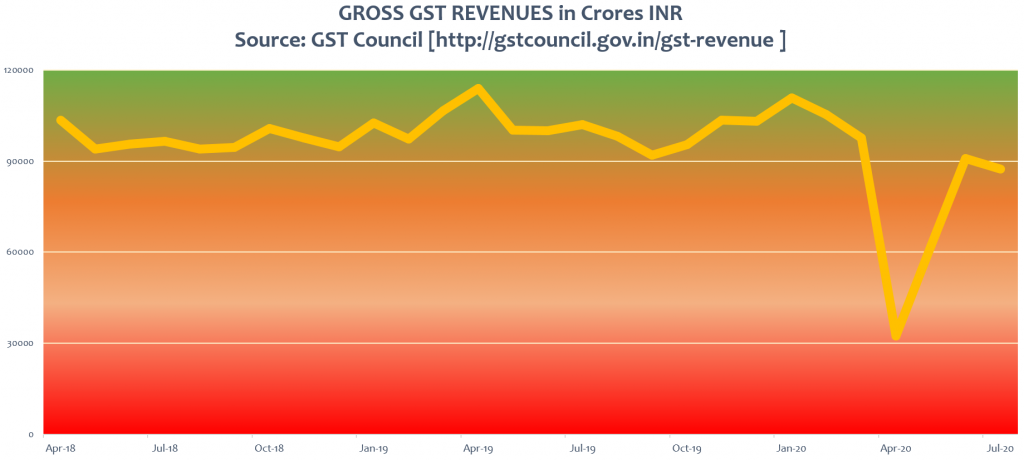

As you might expect from a government full of plans, initiatives and acronyms but empty on delivery, the irrational exuberance behind such a guarantee proved to be misplaced. The 15th Finance Commission had already reported in November 2019 that compensation has to continue well beyond 2022. Apart from large scale data inconsistencies, the report pointed to sluggish growth as the cause for a shortfall in state revenues of 1.67 Trillion INR in 2024-25! One look at the gross GST revenue collections over the years will tell us how anaemic revenue growth has been:

By November 2019, states were already agitated over non-payment of compensation by the Central government for August and September 2019. GDP growth rate declines were compounded by the Central government handicapping its revenue collection further through a Corporate Tax rate cut from 30% to 22% in September 2019. Incidentally, the Union finance ministry noted the big drop in GST revenues between January and April of 2020 as attributable to relief on GST payments during the initial pandemic period.

It is therefore clear that the BJP government was digging itself into a fiscal hole ever since demonetization in 2017. Sitharaman’s claim that it was triggered by the pandemic is being, pardon the pun, economical with the truth. Using the legal term “act of God” only indicates to what extent the BJP government is prepared to go to avoid paying the states their legitimate share of GST revenue.

States that by the way are dealing with the pandemic virtually unassisted by the BJP government. The latter saw undefined opportunity in the pandemic crisis and rolled out an opaque PM-CARES fund. The Prime Minister claimed that the fund would cater to distressing situations if they occur in the times ahead. He has unprecedented control over utilization of the funds. Surely the Union government defaulting on a sovereign promise is, to put it mildly, a distressing situation. Will he release the huge amounts collected by the fund to help the states fight the pandemic and keep the economic engine ticking?

Disclaimer: The opinions expressed within this article are the personal opinions of the author. AlignIndia does not take any responsibility for the content of the article.

(Santhosh D’Souza combines professional interest in technology with a passion for science, history, mythology and current affairs. He tweets @santhoshd)